Article by Andrew Jacobs | The New York Times | March 14, 2019

Researchers combing through archives discovered that cigarette makers had applied their marketing wizardry to sweetened beverages and turned generations of children into loyal customers.

What do these ads featuring Joe Camel, Kool-Aid Man and the maniacal mascot for Hawaiian Punch have in common?

All three were created by Big Tobacco in the decades when cigarette makers, seeking to diversify their holdings, acquired some of America’s iconic beverage brands. They used their expertise in artificial flavor, coloring and marketing to heighten the products’ appeal to children.

That tobacco companies once sold sugar-sweetened drinks like Tang, Capri Sun and Kool-Aid is not exactly news. But researchers combing through a vast archive of cigarette company documents at the University of California, San Francisco stumbled on something revealing: Internal correspondence showed how tobacco executives, barred from targeting children for cigarette sales, focused their marketing prowess on young people to sell sugary beverages in ways that had not been done before.

The archive, known as the Truth Tobacco Industry Documents, was created as part of a settlement between major cigarette companies and states that were seeking to recoup smoking-related health care costs. The researchers published their findings on Thursday in the medical publication BMJ.

Using child-tested flavors, cartoon characters, branded toys and millions of dollars in advertising, the companies cultivated loyalty to sugar-laden products that health experts said had greatly contributed to the nation’s obesity crisis.

At a time of mounting childhood obesity, with nearly a third of children in the United States overweight or obese and rates of type 2 diabetes soaring among adolescents, the study’s authors said it was important to chart how companies created and marketed junk food and sugary drinks to youngsters.

“We have a chronic disease epidemic but we don’t understand the vectors very well,” said Laura A. Schmidt, an author of the study and a professor of health policy at U.C.S.F. School of Medicine. “These documents help us understand how food and beverage companies, using strategic and crafty tactics, got us hooked on unhealthy products.”

R.J. Reynolds and Philip Morris no longer own the drink brands and declined to comment, as did the companies that later acquired the brands.

Experts said tobacco executives had a keen appreciation for the importance of earning customer loyalty at an early age. Jennifer Harris, who studies corporate marketing at the Rudd Center for Food Policy and Obesity at the University of Connecticut, said introducing sweetened beverages to young children can have lifelong implications.

“If a kid gets used to drinking Kool-Aid instead of water, they are always going to prefer a sugary beverage,” said Ms. Harris, who was not involved in the study. “And the advertising creates positive associations with these products in the minds of children.”

Before its atomic red, sweet bouquet came to dominate school cafeterias and birthday parties nationwide, Hawaiian Punch was sold as a cocktail mixer for adults and came in only two flavors. After purchasing the brand in 1963 from the Pacific Hawaiian Products Company, R.J. Reynolds rebranded the beverage for children, according to company documents. Executives expanded the repertoire of flavors to 16, and discontinued Amber Apple, a product favored by mothers, after taste tests with children found they preferred Red Apple.

The centerpiece of their marketing efforts was Punchy, a cheeky pugilist splashed across schoolbook covers, Sunday newspaper comics, drinking cups and branded wristwatches. In the 1960s and ’70s, Punchy made frequent appearances in television ads that touted the drink’s generous supply of vitamin C, but made no mention of the prodigious sugar content that kept children coming back for more. (Even today, Hawaiian Punch contains five percent fruit juice and a single serving has 14 grams of sugar — more than half the recommended daily limit for children.)

In 1973, RJR World, the company’s in-house publication, extolled Punchy’s “instant eye-appeal” and described him as “the best salesman the beverage has ever had.”

Ad from the late 1960s, with Punchy extolling the drink's wholesomeness.

That same year, R.J. Reynolds introduced pop-top eight-ounce cans — “perfect for children,” according to company documents — that provided an alternative to the mammoth 46-ounce metal canisters that had to be punctured by a grown up, armed with a can opener.

By the 1980s, the brand was pulling in $200 million annually, with growth fueled by the introduction of child-friendly juice boxes (“A handy little carton that comes with its very own straw,” promotional material said.) as well as Hawaiian Punch as a shelf concentrate, a frozen cylinder and powders that could be mixed with water.

Dr. Schmidt, one of the study authors, said the marriage of tobacco companies and sweetened beverage brands was about more than marketing. Cigarette companies were frequently introducing new flavored products, and many of the chemicals that went into cherry-scented chewing tobacco and apple-flavored cigarettes found their way into children’s drinks. A 1985 company report attributed the success of Hawaiian Punch to R.J.R. scientists who had created “a beverage formula starting from our knowledge of flavors we already produce or have in our flavor library.” The goal, the report said “is to leave people wanting more.”

Flush with cash, and with the prospect of government regulation mounting, cigarette companies accelerated their purchase of food and beverage companies. In 1985 Philip Morris, impressed by R.J.R.s success with Hawaiian Punch, applied the same marketing techniquesto Kool-Aid, which it acquired when it bought General Foods, according to company documents.

For decades, Kool-Aid had been sold in powder form as a cheaper alternative to soda, with ads aimed squarely at penny-pinching housewives. Philip Morris quickly shifted gears by halving its advertising budget for mothers to $10.7 million, and more than doubling the amount spent on children’s marketing to $6 million, according to company figures.

“We’ve decided to focus our marketing on kids, where we know our strength is the greatest,” a company executive boasted at an industry conference in 1987. “This year, Kool-Aid will be the most heavily promoted kids trademark in America.”

The mascot, Kool-Aid Man, was an anthropomorphized glass pitcher who was fond of crashing through walls and fences, sending terrified adults into goofy pratfalls.

The following year, Philip Morris introduced a loyalty swag program, Wacky Wild Prize Warehouse, modeled on the Marlboro Country Store, which rewarded frequent smokers with branded camping gear, clothing and poker sets.

In 1992, a Philip Morris marketing analysis described Wacky Warehouse — a collaboration with toy makers like Nintendo and Mattel — as “the most effective kid’s marketing vehicle known.” By then, Kool-Aid had expanded into a dizzying constellation of frozen pops, bursts, jammers and shots that came in dozens of flavors like Great Bluedini, PurpleSaurus Rex and colors that changed when mixed with water.

The success with Kool-Aid persuaded Philip Morris it could apply the same marketing magic to Tang, the 1950s-era powdered drink that people of a certain age will recall as the beverage supposedly favored by astronauts. In 1996, Philip Morris, which inherited Tang from General Foods, declared the brand “as dead as the space program.”

The solution: Rebrand Tang for young adolescents.

The company unleashed a wave of television ads that positioned Tang as an “extreme orange breakfast drink for today’s extreme tweens.” The ads featured orangutans on motorcycles and sleepy teens zapped awake by a glass of sugary Tang. The company forged marketing arrangements with Sports Illustrated and Schwinn bicycles and created a loyalty program to rival the Wacky Warehouse.

Tang ended up in the portfolio of the snack food giant Mondelez International, which owns such brands as Oreo, Cadbury and Nabisco. Tang may have lost some of its pizazz in the United States, but it still has broad appeal overseas, especially in the developing world, where it has been creating new flavors to appeal to local tastes. According to the company’s website, Tang brought in $900 million in 2016.

♦ ♦ ♦

About the Author: Andrew Jacobs is a reporter with the Health and Science Desk, based in New York. He previously reported from Beijing and Brazil and had stints as a Metro reporter, Styles writer and National correspondent, covering the American South. @AndrewJacobsNYT

Article by Andrew Jacobs | The New York Times | March 14, 2019 Researchers combing through archives discovered that cigarette makers had applied their marketing wizardry to sweetened beverages and turned generations of children into loyal customers. What do these ads featuring Joe Camel, Kool-Aid Man and the maniacal mascot for Hawaiian Punch have in common? All […]

Source: The New York Times by Tiffany HSU | March 3, 2019

Adding lighter fare like salads to the usual burgers and fries has meant more options for time-pressed diners. But the meals are largely less healthy now, a new study finds.

“The big picture is that there have been some positive changes,” one researcher said of fast food menus, “but they're small, and over all, the changes have gotten worse.”

—Gene J. Puskar/Associated Press

Fast food chains have tried for years to woo health-conscious diners by mixing lighter fare like salads and yogurt with the usual burgers, fried chicken and shakes.

But as menus swelled over the past three decades with grilled chicken wraps (McDonald’s) and “fresco” burritos (Taco Bell), many options grew in size and the calories and sodium in them surged, according to new study from researchers at Boston University and Tufts.

The researchers studied 1,787 entrees, sides and desserts at 10 chains — Arby’s, Burger King, Carl’s Jr., Dairy Queen, Hardee’s, Jack in the Box, KFC, Long John Silver’s, McDonald’s and Wendy’s — from 1986 to 2016. In that time, the number of items in those three categories rose 226 percent.

According to the study — published last week in The Journal of the Academy of Nutrition and Dietetics — even with lighter items in the mix, fast food menus are less healthy than they were 30 years ago.

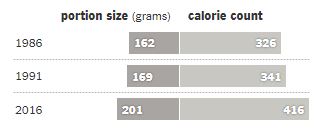

ENTREES

Bulging portions at the heart of the meal

The fat and salt content and the sheer size of fast food meals have long been a public health concern. They are often blamed for pushing up the obesity rate among adults in the United States, which rose to 40 percent in 2016 from 13 percent in the early 1960s.

The new study suggests the problem is getting worse.

Across the 10 chains, the researchers found, the average entree weighed 39 grams more in 2016 than in 1986 and had 90 more calories. It also had 41.6 percent of the recommended daily allotment of sodium, up from 27.8 percent.

“The restaurants really haven’t done enough,” Megan A. McCrory, the lead researcher, said. “The big picture is that there have been some positive changes, but they’re small, and over all, the changes have gotten worse.”

DESSERTS

More than just a little something sweet

In 2016, the average fast food dessert weighed an extra 71 grams and had 186 more calories than the average dessert 30 years earlier, the researchers found.

One possible reason is that restaurants are counting on bigger sundaes and cookies as a way of increasing the amount spent on each order and attracting more customers, said Darren Seifer, a food and beverage industry analyst at NPD.

“The majority of fast food traffic is around lunchtime, when people aren’t typically getting dessert,” he said. “But offering larger portion sizes is one way restaurants can promise more value.”

Just last month, McDonald’s introduced “donut sticks” dusted with cinnamon sugar. Six sticks have 280 calories. But you can also order a serving twice the size for less than the cost of two single orders.

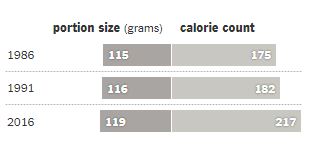

SIDES

Adding those extras adds up

The researchers found that there were 42 more calories on average in items like chips, soups and French fries in 2016 than there were in 1986. Sodium content rose to 23.2 percent of the recommended daily allotment from 11.6 percent, even though portion size did not grow substantially.

Consumed together as a single meal, the study found, the average entree and side account for nearly 40 percent of a 2,000-calorie daily diet.

The study mentions several proposals meant to help consumers scale back their fast food intake, including a system that would let them order smaller portions at lower prices.

Whether the industry will embrace such ideas is unclear. In the meantime, menus continue to grow, sometimes blurring the line between entree and side. Jack in the Box is testing Burger Dippers, which the company describes as “the burger you eat like a fry.”

Ordered with cheese, it has more than 700 calories.

Sources: Megan A. McCrory, Allen G. Harbaugh, Sarah Appeadu, Boston University; Susan B. Roberts, Tufts University.

Tiffany Hsu is a breaking news reporter on the Business Desk. Before joining The Times in 2017 she covered economic news for The Los Angeles Times and earned an M.B.A. from Columbia University. @tiffkhsu

Source: The New York Times by Tiffany HSU | March 3, 2019 Adding lighter fare like salads to the usual burgers and fries has meant more options for time-pressed diners. But the meals are largely less healthy now, a new study finds. “The big picture is that there have been some positive changes,” one researcher […]